This article is more than 1 year old

Series of Seagate missteps as revenue generator spins down

Catalogue of errors by stuck-in-the-rut firm

Comment Here's a suggestion – Seagate, led by a combined chairman and CEO, has made a catalogue of tactical errors in the face of the NAND tidal wave while rival Western Digital has pivoted sideways to embrace flash.

Is Seagate sensibly husbanding its resources because, while flash will store edge and enterprise fast-access data, the rest of it, the increasing rest of it, will be stored on growing amounts of disk?

Which thesis is right? Let's set the scene with annual revenue comparison charts and then play the tactical errors argument.

Annual revenue curves

The two twin pillars of the disk drive business are Seagate and Western Digital. Let's compare their annual revenues over recent years:

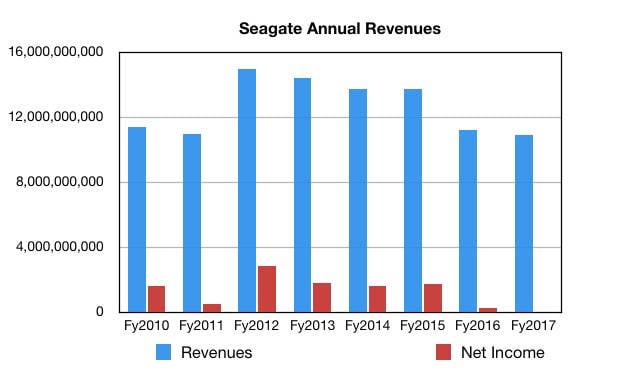

Seagate annual revenues in US$

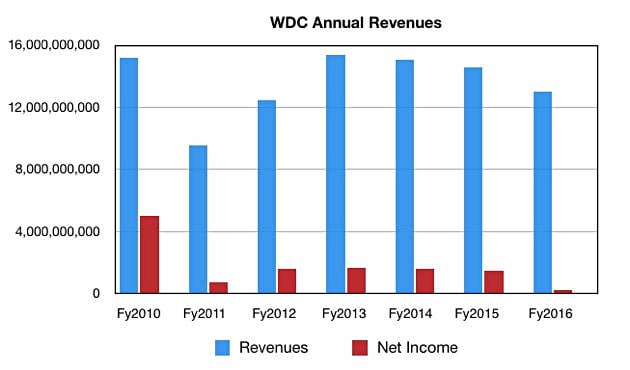

Western Digital annual revenues in US$

Both charts show a rise-and-fall pattern, with Seagate's more marked. Tellingly, since 2012 Seagate annual revenues have declined from $14.94bn to $11.2bn in fiscal 2016, down 25 per cent, and a projected $10.9bn in fiscal 2017.

The picture for Western Digital over the same period is a rise from fiscal 2012's $12.48bn to fiscal 2016's $13bn. It has gained $0.52bn revenue over the period while Seagate has lost $3.74bn, a $4.26bn difference in performance

It appears that WDC has been managed better than Seagate since 2012.

Tardy entry into helium drives

When perpendicular magnetic recording (PMR) began to hit the buffers in terms of areal density improvements after 2010, WD subsidiary HGST began to develop helium-filled drive technology. The drives were filled with helium instead if air, and it had lower friction than air, meaning disk platters didn't need to be so strong, and could be thinner, meaning more could be fitted inside a standard drive enclosure, meaning an 80 per cent or better capacity increase.

Seagate preferred to develop shingled magnetic recording as a a PMR capacity boost and look to post-PMR HAMR (heat-assisted magnetic recording) technology, then slated to arrive in 2016, as its areal density get-out-of-PMR-jail card.

But WD developed SMR as well as helium-filled drive technology, leaving Seagate in an air-filled hole until it introduced its own helium drive technology in 2016, four years after WD, with a seven-platter, 10TB drive.

In essence Seagate was four years late in delivering helium-filled drive technology, giving WD an advantage.

Hybrid flash-disk drives

When SSDs began to become popular as a means of getting much faster read-write access to data than disk, flash bits were far more expensive than disk bits. The obvious halfway house was to fit a small slug of flash cache to disk drives and so speed up access to high-priority data.

Seagate, and lots of other companies, took to this view and introduced what became a stream of hybrid small form factor (2.5-inch) drives for notebooks and even tablet computers. The first was a Momentus 5400 PSD drive in 2006. It was followed by the Momentus XT in May 2010.

Back in 2012, we wrote that "Luczo said that by 2017 over 85 per cent of Seagate's HDD production will be of hybrid drives, covering both consumer and enterprise products. Cold boot times are just 2 secs slower than an SSD, making hybrid HDDs a good fit for the tablet and Ultrabook notebook market."

However, it was not to be. The price of flash bits fell fast enough for buyers to split into two camps; SSD fans willing to spend cash on performance, and disk fans preferring to spend it on capacity. Tablet computers went for flash because of concerns about power consumption, weight and fragility around disks. Suppliers like Apple twinned proper SSDs with disk drives in its Fusion drive idea.

Performance-hungry desktops and workstations plumped for SSDs. Enterprise data centres began replacing fast 2.5-inch disk drives with SSDs too and, basically, the hybrid flash/disk drive market was going nowhere.

Seagate would have made a better choice by going full tilt into supplying SSDs, which is what fellow disk drive manufacturers Toshiba and Western Digital did.

Kinetic fiasco

In 2013 Seagate introduced its Kinetic disk drive technology. These drives had a direct Ethernet interface, not SATA or SAS, and implemented a key-value store with a Get and Put-style object access API. The traditional disk drive software access stack, deemed inefficient, would go away for storing unstructured data and left for data centre equipment suppliers.

It was basically balderdash at the enterprise data centre scale, certainly at that time. There was a footling industry alliance set up, lip service paid by other disk drive manufacturers, and mini-marketing coups like CERN involvement.

It was all an engineering wet dream. No one wanted to use proprietary Seagate tech in this way. The Ethernet-access disk drive s now being made by a small French startup, OpenIO, which bolts an ARM server on to a disk drive.

The Kinetic drive fiasco was a distraction from the main event; the impact of flash on disk, and Seagate wasted time and resources on a pipe dream.

EVault

Thinking that more money could be made by moving up the stack, Seagate bought cloud storage supplier EVault for $185m in late 2006 and set it up as an independent subsidiary. It rebranded it i365 in 2008, changed it back to EVault in 2011, attempted to use Kinetic drives as storage in 2013, brought it in-house in 2014, combining it with acquired Xyratex ClusterStor arrays in a Cloud Systems and Solutions Group, doing a partnership deal with Iron Mountain as well.

It was all to no avail. EVault head Terry Cunningham left in 2015 and Seagate sold EVault to Carbonite in December 2015, when we wrote: "Seagate has offloaded its EVault cloud backup service for a mere $14m, virtually giving away what it originally bought for $185m."

Veering away from vertical NAND integration

Seagate has been a pioneer and vigorous exponent of vertical integration in the disk drive business. It builds its own head and platters and manufactures its own drives.

The company has also driven supplier consolidation in the business, being an active consolidating agent as it bought up other suppliers. Now there are just three disk drive manufacturers worldwide: Seagate, Toshiba and WD. Of these Toshiba and WD are vertically integrated SSD suppliers but Seagate is not.

What Seagate has done is to acquire flash product suppliers and buy in NAND chips for its SSDs. At an August 2016 Flash Memory Summit, it said there were four aspects to its flash product strategy:

Seagate 2011 flash product strategy

Seagate has acquired companies such as LSI's flash business from Avago for $450m in May 2014.

This was trivial in scope when compared to WD and subsidiary HGST's hoovering up a string of flash suppliers: Virident, sTec, Velobit, SanDisk with its Toshiba flash foundry joint venture, and Skyera.

Flash foundry operators like Samsung, Intel-Micron, SK Hynix and Toshiba-WD build SSDs. WD builds a flash array already. The profitable lessons of disk drive vertical integration are there for all to see.

We cannot understand why Seagate does not recognise the long-term effect on its business of customers storing bits on flash and securing its own supply of flash bits and system manufacturing skills. These are things it has learnt in the disk drive business through long and successful experience.

Why does it forget these lessons when looking at flash?

Corporate governance issue

Seagate chairman Steve Luczo, in office since June 2002, having been CEO from 1998 to 2002, oversees the performance of Seagate CEO Steve Luczo. Does he have too much power by holding these combined roles, and is he a brake on the company's progress?

Luczo was chairman when Bill Watkins became CEO in 2004, and took over the CEO role a second time when Watkins resigned in January 2009.

The Harvard Law School Forum writes:

In recent years, companies have consistently moved toward separating the chairman and CEO roles. According to Spencer Stuart, just over half of companies in the S&P 500 Index are led by a dual chairman/CEO, down from 77 percent 15 years ago. In theory, an independent chairman improves the ability of the board of directors to oversee management. However, separation of the chairman and CEO roles is not unambiguously positive, and there is little research support for requiring a separation of these roles. Still, shareholder activists and many governance experts remain active in pressuring companies to divide their leadership structure.

We would suggest that when the chairman and CEO is the same person, the company's willingness to thoroughly examine strategic alternatives to events in its market is limited by that person's openness to independent and different points of view. The Investopedia outlet also notes:

- It is the board of directors that votes to increase executive pay. When the CEO is also the chairman, a conflict of interest arises, as the CEO is voting on his or her own compensation.

- A board monitors the operations of the company, run by the CEO, and chairman/CEO is monitoring himself, opening the door for abuse of the position.

- When the board audit committee, a sub-group of the board of directors, reports to the chair who is also the CEO, this limits the effectiveness of the committee.

Ideally then, the CEO and chairman roles should be held by different people.

The positive thesis

A positive thesis would have it that Seagate is right to concentrate on developing its core business as long-term data growth is unceasing and disk is the only viable technology to use when storing it for prompt access, with tape for the longer haul.

Seagate can earn more money and deliver more value to shareholders by sticking to its mainstream disk knitting and building up its flash and disk array sideshows in a controlled way, without diverting too much capital from its disk manufacturing and shareholder needs.

What to think?

So far, since 2012, this thesis has not worked for Seagate, its sales having fallen $3.74bn over that period while WD's have risen $0.52bn.

El Reg thinks Seagate has moved on from its buccaneering early days and become a staid and careful, even fearful, corporation. It has misplayed its flash hand, misjudged the market and technology, and will fall further behind WD.

As other foundry operators vertically integrate upward beyond SSDs and into systems, it will find its own SSDs and systems become more expensive to build. It may even find its prime cloud buyers of disk drives, like Amazon, looking to buy disk drives at the component level.

If you believe the negative thesis then Seagate needs a new chairman and a new CEO. If you prefer the positive thesis then everything is fine and dandy. Your choice. ®