This article is more than 1 year old

Big Blue weeps as another 8% slips off its storage scales

IBM's still swimming in billions of dollars, mind

Comment When is Big Blue's storage slide going to end? IBM's latest quarterly and full year fiscal 2014 results show an unabated fall in storage hardware revenues, with an eight per cent annual decline to $864m in the fourth quarter of 2014.

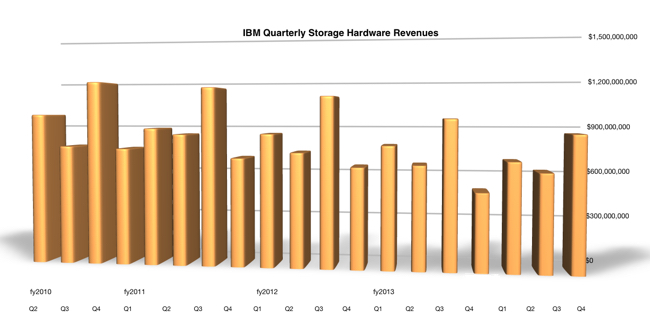

It's a huge number, but back in fiscal 2011 the same quarter recorded $1.2bn in storage hardware sales. Charting the numbers illustrates the point we're making; IBM's storage hardware sales trend is dire.

Just look at the seasonally high Q4 peaks in the chart below and notice the steady downward trend.

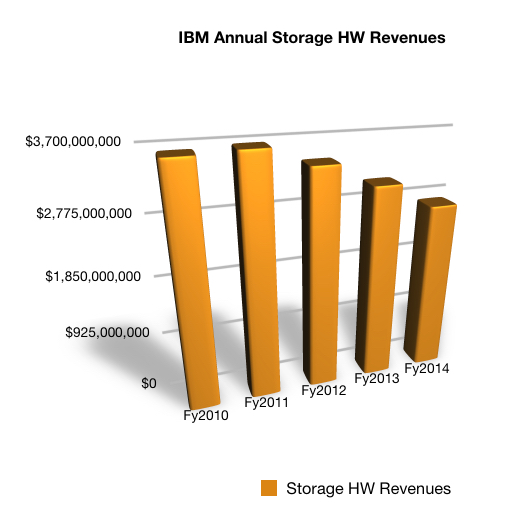

Charting annual storage hardware revenues smooths out the quarterly saw teeth and shows the storage slump with more clarity:

In four years the annual storage hardware revenue number has gone from $3.68bn through $3.4bn and $3bn to fiscal 2014's $2.69bn.

Where is it going to end? IBM offered no clue.

CFO Martin Schroeter said: "Our Storage hardware revenue was down five per cent at constant currency ... We again saw strong growth in our FlashSystems and Storwize portfolio. This growth was offset by the wind down of our legacy OEM business and continued weakness in high-end disk."

The z13 mainframe product may drive increased high-end disk (DS8000 storage array) sales. Schroeder said: "Analytics was up seven per cent on a large base," something that could drive storage sales in the integrated Pure Analytics systems. But it is hard to see where else storage sales might receive any boost.

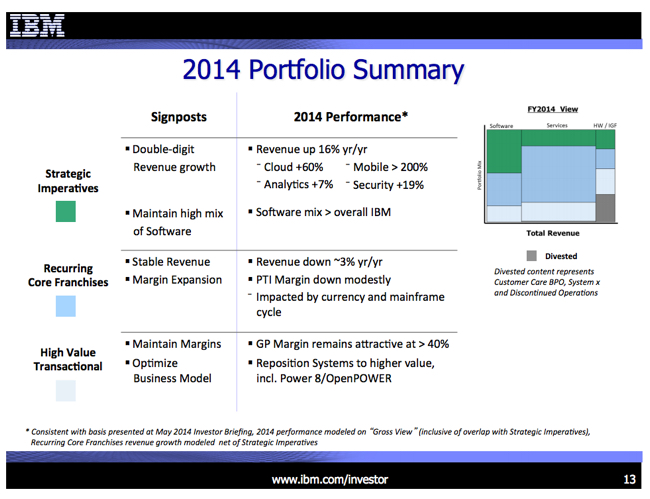

Storage is not an IBM strategic imperative, like cloud, mobile and analytics, where revenues are growing in double digits. It is characterised as a high-value transactional business (with gross product margin of more than 40 per cent). Schroeter said: "The objective here is to optimize our business model, and maintain margins."

Storage is in the High Value Transactional sector in IBM's portfolio

Optimising the business model includes repositioning systems to higher value.

Our view is that IBM's storage is profitable overall; there is no mention of getting out of that business, but there is also no mention of arresting its revenue decline. As long as the business makes money IBM seems happy to keep it simply ticking along. ®