This article is more than 1 year old

EMC's curate's egg sees revenues waiting for new product take-offs

Old storage wilts and there's not enough new stuff yet

EMC’s first quarter results were like the curate's egg; good in parts, but hit by currency problems, job cuts and unsatisfactory core storage revenues in others.

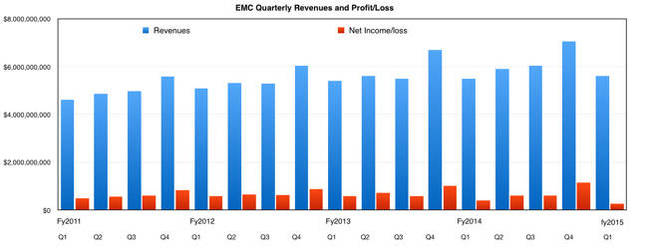

First-quarter 2015 revenues were up 2 per cent to $5.6bn, compared to $5.5bn a year ago, with EMC II (the core storage biz) revenues disappointing. The top-line number was $75m lower than the firm's forecasts.

On a conference call with analysts, EMC Federation chairman and CEO Joe Tucci stated: "This $75 million revenue shortfall occurred in our storage business. That said, our storage product backlog did increase by $100m year-on-year, right on plan."

He added: "I want to make it clear that we could have and should have made this revenue plan, and we offer you no excuses. About two-thirds of this miss was due to the fact that we didn't execute as crisply as we normally do. The other third was due to negative geopolitical effects in Russia and China that slowed down bookings."

More specifically, EMC said axing 1,500 jobs didn't exactly help to oil the machine in the quarter. On the mass redundancy programme, EMC Information Infrastructure CEO David Goulden said:

"Obviously when you do something of that size, it did impact some of our field-facing parts of the business and that caused a bit of a slowdown in terms of how quickly we got out of the gate."

EMEA revenues were down 2 per cent year-on-year at $1.56bn. North America revenues were up 5 per cent at $3.2bn. Latin America was up 8 per cent at $192m and Asia/Pacific/Japan grew 1 per cent to $729m.

Net income of just $252m compared to the $392m achieved a year ago – a 36 per cent drop – shows it was a tough quarter.

CFO Zane Rowe indicated it had indeed been difficult: ”By realigning our organisation and optimising our investments, we were able to drive further cost efficiencies in the quarter.”

Drilling deeper, EMC Federation member first quarter results with annual compares look like this:

- EMC Information Infrastructure revenue was down 1 per cent, but up 3 per cent on a constant currency basis. Information Storage revenue was flat, but up 3 per cent on a constant currency basis:

-

- Emerging Storage revenue had solid growth, with strong growth for XtremIO and Isilon products

- RSA revenue grew 1 per cent

- Vblock-related revenue was up more than 30 per cent

- VMware: revenue within EMC was up 12 per cent.

- Pivotal revenue grew 8 per cent and subscription revenue was significantly up as Pivotal continued its transition to a software subscription business model

Nothing to write home about

Within EMC II, the business revenues were:

- Information storage: $3.66bn ($3.68bn a year ago) and within that:

-

- High-end $871m, down 7 per cent

- Unified Back-up and Recovery $1.28bn, down 11 per cent

- Emerging storage $542m, up 14 per cent

- Storage – other and PS $967m, up 16 per cent

- Enterprise content $138m ($154m a year ago) down 10 per cent – the expected poor result

- RSA $248m ($244m a year ago) up 1 per cent

Hold up, what’s the problem in the back-up/recovery biz? Goulden said customers became aware that a Data Domain product refresh is taking place this quarter and postponed purchases.

"Expect the announcement at EMC World that probably will start shipping in the middle of this quarter. So that should take that pressure away," he said.

The high-end dip was down to below-par VMAX sales, where XtremIO is eating the performance storage business.

Stifel Nicolaus MD Aaron Rakers thinks that “the percentage of XtremIO deployments for workloads previously supported by VMAX/VNX is higher than 33 per cent (i.e. possibly into the 40 per cent range)... XtremIO had a ~35 per cent share of the all-Flash array market in 4Q14.”

He mentioned that Isilon had done well: “Isilon’s native support for Hadoop is a compelling value proposition, with Isilon winning a leading hyperscale customer in 1Q15.”

Zooming in on EMC II, Goulden claimed: “With most of the factors that impacted first-quarter storage revenue versus our expectations now behind us, the future is rich with opportunity for EMC Information Infrastructure.”

William Blair analyst Jason Ader noted in a post: “Management expects emerging storage to grow at least 30 per cent for the year and to exit the year as the second-largest category at EMC. All told, the company's six key growth areas – AirWatch, NSX, Pivotal, Scale-IO/ViPR/ECS, DSSD and XtremIO – grew well over 100 per cent year-over-year and are on track for the stated 2015 revenue target of $2 billion.”

It expects $25.7bn consolidated revenue for the full 2015 year: it had expected $26.1bn at the mid-point of its range. Full 2014 revenue was $24.4bn.

Comment

This is a set of results that can be read two ways. Optimists can point to all the good news and see jam tomorrow. Pessimists (and activist shareholders) can focus on the revenue-declining parts of the business and say this castle in the sand is being washed away by secular tides and something needs to be done, like selling off VMware.

Previous storage business transitions were dealt with effectively by EMC: witness the acquisitions of Data Domain and Isilon and object storage developments. The current group of transitions – all-flash arrays, hyper-converged and converged systems, and software-defined storage – are proving too powerful and fast-moving and overall simply too much to deal with all at once.

No other mainstream storage company is so involved in cannibalising its own products in attacking on all these transition fronts. If EMC emerges successful, which it most probably will, then it will be an even stronger company than before.

The jam (increased revenues) has to come this year – and be seen to be continuing into next year, we believe – if the activist investors are to be fought off. ®